Ever dreamt of financial freedom? Imagine reaching your investment goals without the constant worry of market fluctuations. Dollar-cost averaging (DCA) might be the strategy you’ve been looking for. This straightforward approach helps smooth out the bumps in the market, potentially reducing risk and making investing less intimidating. Let’s dive in and explore how dollar-cost averaging works in investing.

What is Dollar-Cost Averaging?

Dollar-cost averaging is an investment strategy where you invest a fixed dollar amount at regular intervals, regardless of the asset’s price. This means you’ll buy more shares when prices are low and fewer shares when prices are high. Instead of trying to time the market, DCA focuses on consistent investing over time.

How Does DCA Work?

The mechanics of dollar-cost averaging are simple. Let’s say you decide to invest $200 every month in a particular stock. One month, the stock price is $10 per share, so you buy 20 shares. The next month, the price drops to $5 per share, allowing you to purchase 40 shares. In the third month, the price rises to $20 per share, so you only buy 10 shares. Over time, this consistent investment averages out your purchase price, potentially reducing the impact of market volatility.

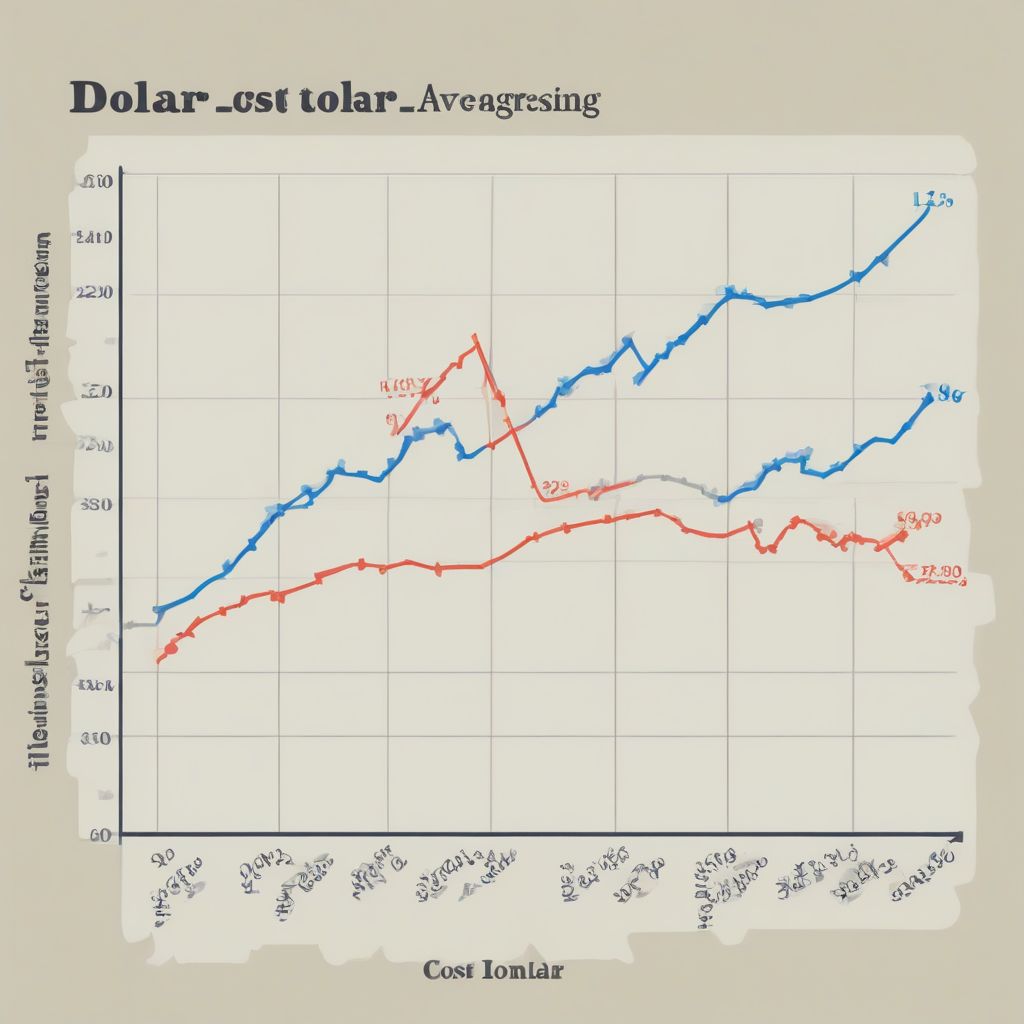

Dollar-Cost Averaging Chart

Dollar-Cost Averaging Chart

Benefits of Dollar-Cost Averaging

Reduced Emotional Investing

One of the biggest advantages of DCA is its ability to reduce emotional investing. When markets are volatile, it can be tempting to panic sell or chase hot stocks. DCA takes the emotion out of the equation by automating your investments. As Warren Buffet famously said, “Be fearful when others are greedy and greedy when others are fearful.” DCA helps you adhere to this principle.

Lower Average Cost per Share

By investing consistently through market ups and downs, you’re likely to achieve a lower average cost per share over the long run compared to investing a lump sum at a potentially unfavorable time.

Simplified Investing

DCA is a straightforward strategy that requires minimal effort. Once you set up your automatic investments, you don’t need to constantly monitor the market or make frequent trading decisions.

Drawbacks of Dollar-Cost Averaging

While DCA offers several advantages, it’s crucial to understand the potential drawbacks.

Missed Gains in Bull Markets

In a consistently rising market (a bull market), DCA might underperform a lump-sum investment. This is because you’re not fully invested from the start and might miss out on some potential gains.

Transaction Fees

If you’re investing small amounts regularly, transaction fees could eat into your returns. Choose a brokerage with low or no fees for regular investments.

When is Dollar-Cost Averaging a Good Idea?

DCA is particularly beneficial for:

- New investors: It’s a great way to get started with investing without feeling overwhelmed by market fluctuations.

- Lump-sum inheritances or bonuses: Instead of investing a large sum all at once, DCA can mitigate the risk of investing at a market peak.

- Investing in volatile assets: DCA can be particularly useful when investing in assets like stocks or cryptocurrencies, which can experience significant price swings.

When to Consider Lump-Sum Investing

Lump-sum investing might be a better option if:

- You have a large sum of money and are comfortable with market risk.

- You have a long-term investment horizon and expect the market to trend upwards.

- You want to maximize potential returns in a bull market.

How to Get Started with Dollar-Cost Averaging

Starting with DCA is easy:

- Choose your investment: Select a low-cost index fund, ETF, or individual stock.

- Set a regular investment amount and schedule: Decide how much you can comfortably invest and how frequently (e.g., weekly, monthly, or quarterly).

- Automate your investments: Set up automatic transfers from your bank account to your brokerage account.

Dollar-Cost Averaging vs. Lump-Sum Investing: A Hypothetical Example

Let’s consider a hypothetical example. Imagine you have $12,000 to invest. With lump-sum investing, you invest the entire amount at the beginning of the year. With DCA, you invest $1,000 per month for 12 months. If the market goes up consistently, the lump-sum strategy might yield higher returns. However, if the market fluctuates significantly, DCA might offer better protection and potentially a lower average cost.

Conclusion

Dollar-cost averaging is a powerful strategy for reducing risk and simplifying investing, especially for those new to the market or dealing with large sums of money. While it might not outperform lump-sum investing in a consistently rising market, it offers valuable peace of mind and can be an effective way to achieve long-term financial goals. Remember, investing involves risks, and no strategy guarantees profits. Consider your own financial situation and risk tolerance before making any investment decisions.

What are your thoughts on dollar-cost averaging? Share your experiences and questions in the comments below!