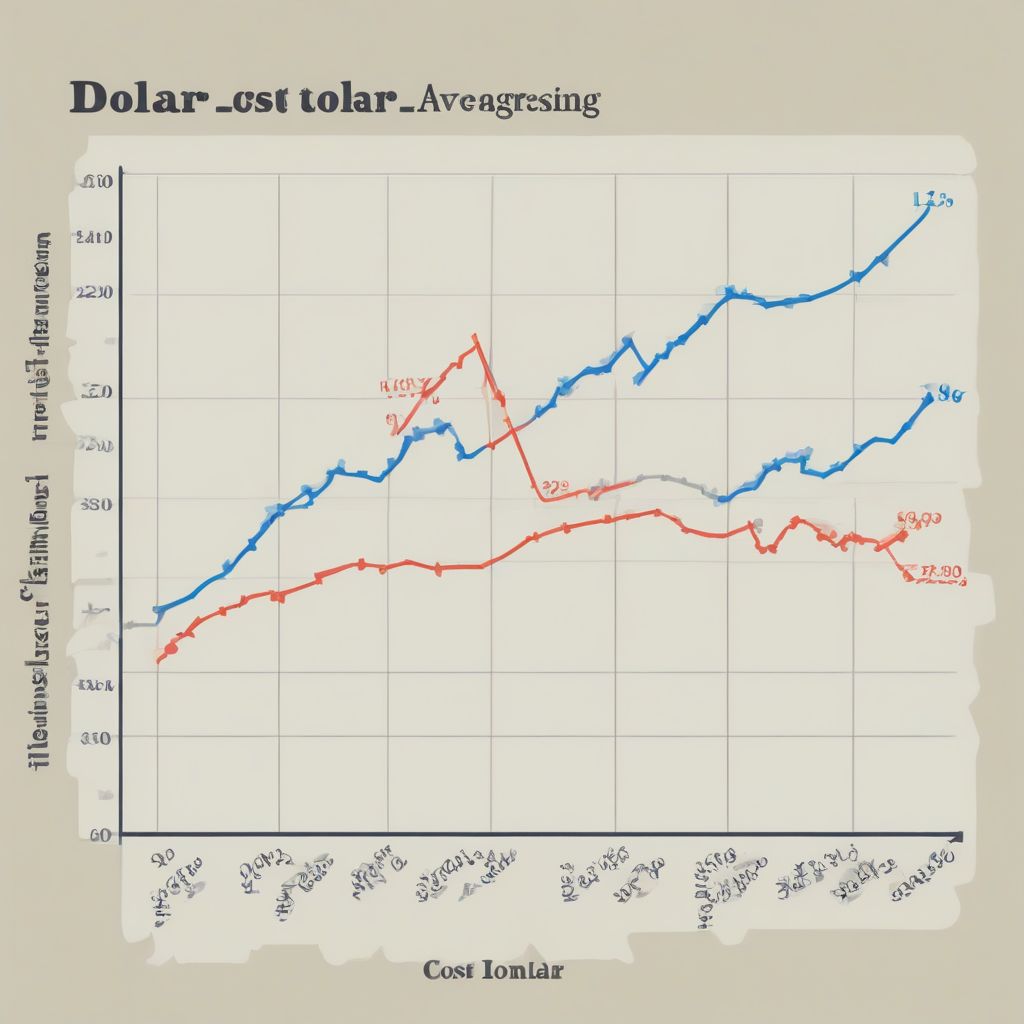

How Dollar-Cost Averaging Works in Investing: A Simple Guide to Reducing Risk

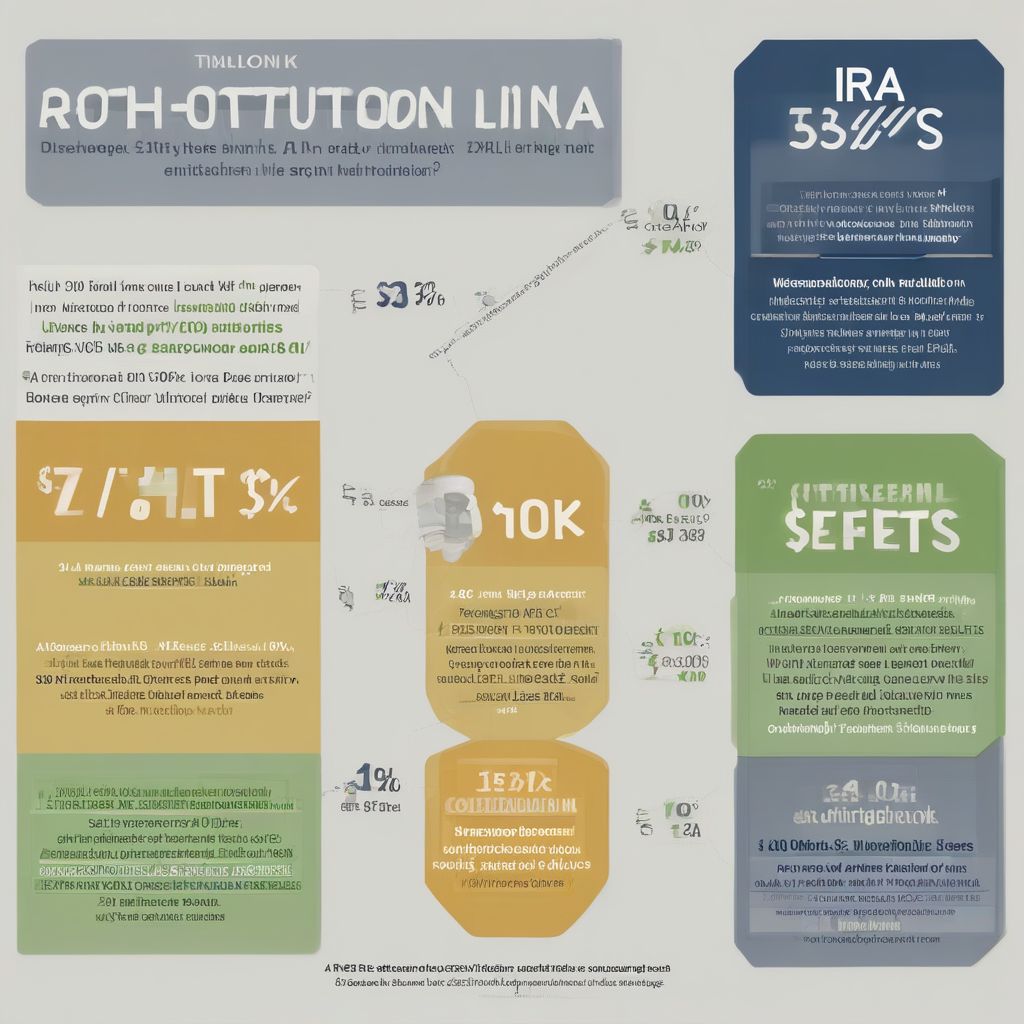

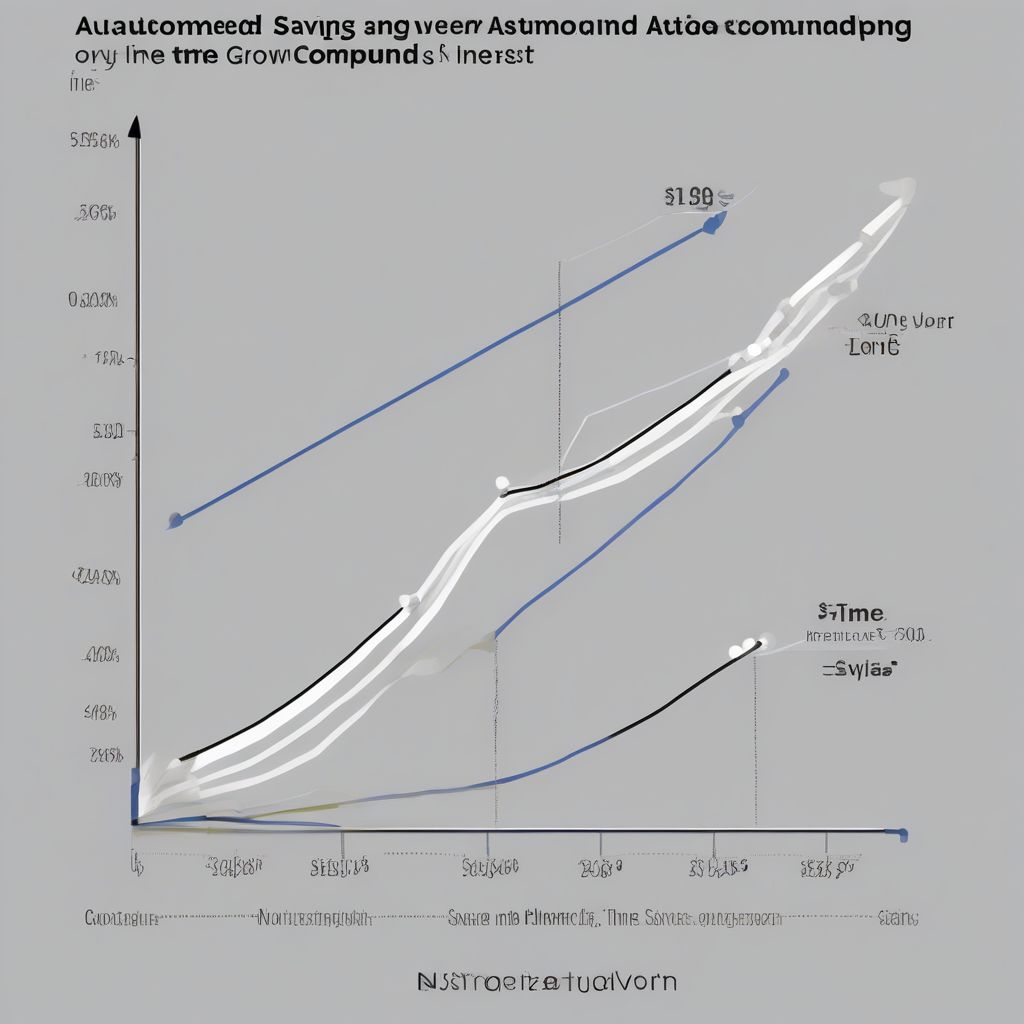

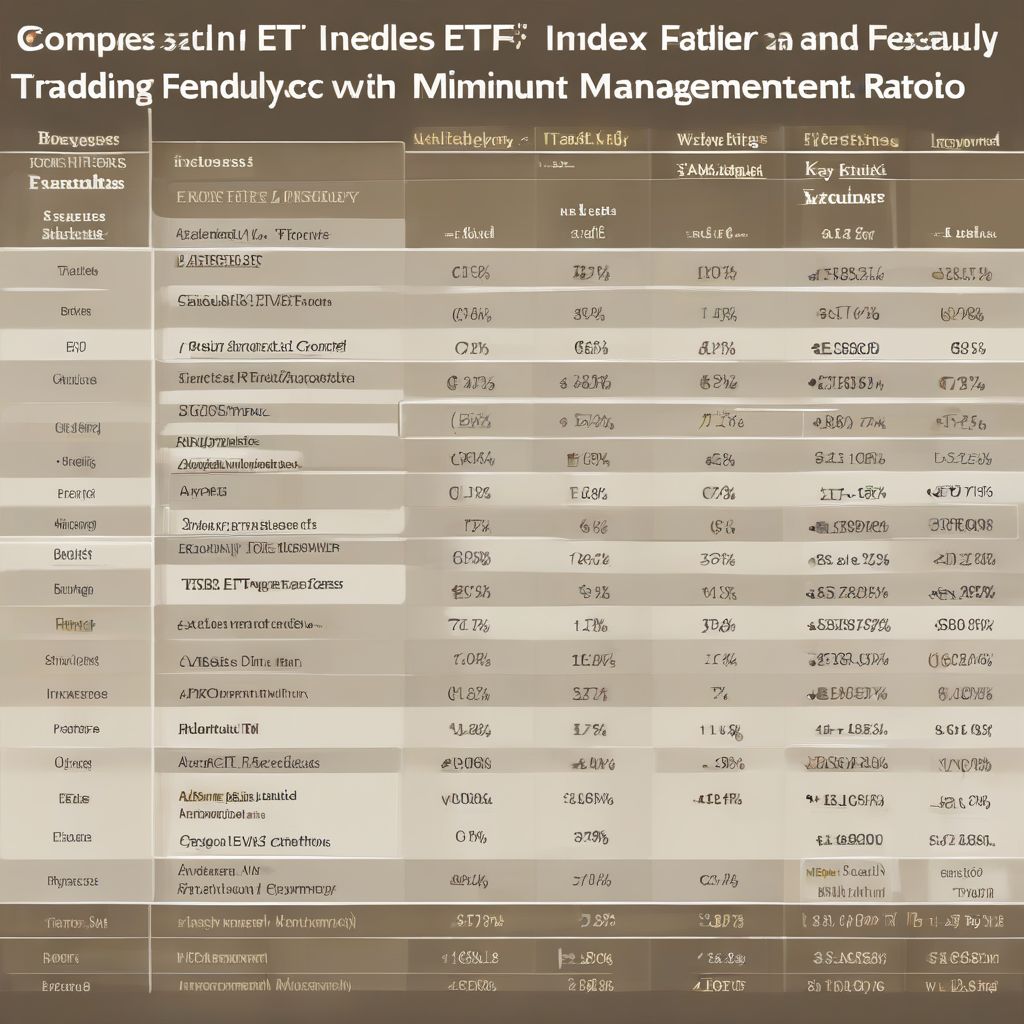

Ever dreamt of financial freedom? Imagine reaching your investment goals without the constant worry of market fluctuations. Dollar-cost averaging (DCA) might be the strategy you’ve been looking for. This straightforward approach helps smooth out the bumps in the market, potentially reducing risk and making investing less intimidating. Let’s dive in and explore how dollar-cost averaging … Read more